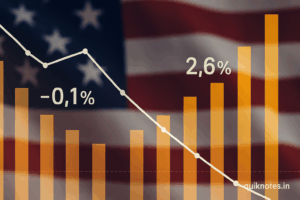

The U.S. Producer Price Index (PPI) for August recorded a year-over-year increase of 2.6%, down significantly from 3.3% in July and falling short of expectations. Monthly, PPI declined 0.1%, contrasting with a 0.9% rise in July and missing forecasts of a 0.3% gain, according to the Bureau of Labor Statistics.

Key Highlights

- Headline PPI (YoY): 2.6% for the 12 months ending August, down from July’s 3.3% and below economists’ forecast of 3.3%.

- PPI (MoM): Decreased by 0.1% in August, reversing July’s 0.7% increase and falling short of the anticipated 0.3% rise.

- Core inflation indicator: PPI excluding food, energy, and trade services—often viewed as a gauge of underlying inflation pressures—was not highlighted in the release, but related metrics indicate moderating trends.

What’s Driving the Slowdown?

- Sector breakdown: The drop in August’s headline PPI was largely driven by a 0.2% decline in final demand services, especially due to narrowing trade margins such as machinery and vehicle wholesaling. In contrast, goods prices inched up 0.1%, led by specific categories like tobacco.

- Cooling pressures: After robust gains in July, both food and energy components—often volatile—appear to be contributing less to inflation, signaling easing producer-level inflation ahead of key consumer price numbers.

Implications & Market Reaction

- Monetary policy impact: With the PPI slowing sharply, inflation pressures are easing at the producer gate. This could bolster expectations for monetary flexibility from the Federal Reserve, which faces mounting pressure from recent weak labor data.

- Market sentiment: Ahead of the report, markets were cautious, with stock futures in flux and bond yields reacting to softer inflation expectations.

Analytical Perspective

Moderating producer inflation bodes well for consumers if pass-through effects continue to dwindle. A shrinking PPI may temper input cost pressures and ultimately be reflected in lower or more manageable Consumer Price Index (CPI) readings.

However, continued declines in core PPI components could indicate broader structural disinflation—something the Fed will weigh against a still fragile employment backdrop.

Summary Table

| Metric | August 2025 | July 2025 | Expectations |

|---|---|---|---|

| PPI (YoY) | +2.6% | +3.3% | +3.3% |

| PPI (MoM) | -0.1% | +0.7% | +0.3% |