Summary:

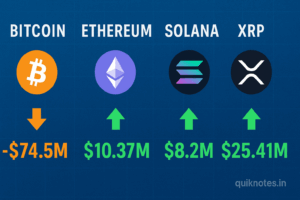

On November 17, spot exchange-traded funds (ETFs) in major cryptocurrencies recorded notable shifts: Bitcoin (BTC) ETFs posted ~US$74.5 million in net outflows, while Ethereum (ETH) spot ETFs saw ~US$10.37 million in net inflows. Meanwhile, spot ETFs tracking Solana (SOL) received ~US$8.2 million in inflows, and XRP ETFs drew about US$25.41 million in inflows.

Flow Details

- Bitcoin spot ETFs: approx US$74.5 million outflow on Nov. 17.

- Ethereum spot ETFs: approx US$10.37 million inflow.

- Solana spot ETFs: approx US$8.2 million inflow.

- XRP spot ETFs: approx US$25.41 million inflow.

These figures come from industry-aggregated data on spot crypto-ETF flows for the trading day.

Market Context & Interpretation

- The outflow in Bitcoin spot ETFs suggests some investors are reducing exposure to the largest crypto asset, possibly due to profit-taking, macro concerns, or rotation.

- Ethereum’s modest inflow indicates renewed interest, albeit much smaller than large cap funds typically see.

- Inflows into SOL and XRP show that investors may be shifting capital toward altcoin spot-ETF vehicles, perhaps hunting value or diversification beyond BTC/ETH.

- The contrast underscores a subtle sentiment change: while BTC remains dominant, money may be flowing into assets perceived as “next-wave” or offering differentiated use cases.

- The volumes, though not massive relative to total market size, are directional signals worth monitoring for institutional sentiment.

Implications for Investors & Markets

- Asset rotation: The trend may mark the beginning of a broader shift in portfolio allocations within crypto ETFs — from “macro” exposure (BTC) toward selective altcoins (SOL, XRP).

- Liquidity & price dynamics: Net outflows from Bitcoin ETFs could weigh on liquidity for BTC-underlying stocks/ETFs and spot markets; inflows into altcoin ETFs might support underlying assets.

- Product development: The rising interest in SOL and XRP ETFs could spur more spot-ETF product launches for other protocols, increasing competitive pressure and investor choice.

- Risk-reward balance: For investors, the data suggests a shift in risk appetite: retaining core holdings like BTC/ETH but supplementing with higher-growth altcoins via ETF wrapper.

What to Watch Next

- Will the outflow in Bitcoin ETFs accelerate or reverse? Large sustained outflows could signal a structural change.

- Can the inflows into SOL and XRP be sustained, or are they a short-term rotation? Tracking cumulative inflows over weeks is key.

- How do macro factors (interest rate expectations, equities performance, regulatory news) influence crypto-ETF flows?

- Are new altcoin spot-ETFs or thematic products emerging that could capture the inflow theme beyond SOL/XRP?

- How do these flows correlate with underlying spot price performance, ETF premiums/discounts, and arbitrage behaviour?

Bottom Line

November 17’s flow data indicate a modest but meaningful divergence in crypto-ETF investor behaviour: capital is exiting Bitcoin spot-ETFs while entering ETFs for ETH, Solana and XRP. While this is not yet a major paradigm shift, it may represent the early stages of a broader allocation shift toward altcoin exposure within the structured ETF space. Investors should watch whether the pattern stabilises or grows into a persistent trend.

Also Check: Ethereum Holders Mobilize Coins 3× Faster Than Bitcoin, Says Glassnode — Signal of Utility Over Hoarding

Z1EOHIHI