Summary:

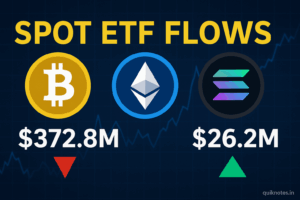

On November 18, 2025, spot crypto exchange-traded funds (ETFs) recorded substantial flows: the Bitcoin (BTC) spot ETFs posted a net outflow of approximately US$372.8 million, while Ethereum (ETH) spot ETFs also saw outflows of around US$74.2 million. Meanwhile, the Solana (SOL) spot ETFs attracted fresh inflows of about US$26.2 million, suggesting a rotation of institutional capital toward altcoin-based vehicles.

Flow Data

- BTC spot ETFs: ~US$372.8 million net outflow on Nov. 18.

- ETH spot ETFs: ~US$74.2 million net outflow on the same day.

- SOL spot ETFs: ~US$26.2 million net inflow.

Market Context & Interpretation

The data reflects a continuation of a trend where large-cap crypto funds (BTC and ETH) are seeing capital exit, while some newer or alternative crypto assets (such as SOL) are benefitting from inflows:

- The heavy outflow from BTC spot ETFs could reflect profit-taking, increased caution among institutional holders, or a broader shift in sentiment amid macro headwinds.

- ETH’s outflow, though smaller than BTC’s, still shows less positive momentum compared with the altcoin segment.

- The positive inflow into SOL spot ETFs signals selective interest in assets beyond the “big two,” likely driven by growth narratives, diversification strategies, or anticipation of protocol developments.

- The divergence may indicate that while the “store-of-value” narrative for BTC/ETH remains strong, investors are beginning to allocate more toward “growth-stage” crypto exposures via regulated ETF wrappers.

Implications for Investors & Markets

- Capital rotation: Investors are potentially reallocating out of BTC/ETH and into altcoins within the ETF structure, implying a shift in risk-return appetite.

- Liquidity implications: Significant outflows from BTC/ETH may put downward pressure on associated fund NAVs and underlying markets, while SOL inflows could provide support to its ecosystem.

- Product evolution: The inflows into SOL suggest that altcoin spot ETFs are gaining traction, which may prompt more launches and greater institutional engagement beyond the largest assets.

- Sentiment indicator: These flows serve as a barometer of institutional sentiment — namely that participants may be looking beyond the legacy crypto heavyweights for opportunity.

What to Watch Next

- Whether BTC and ETH spot ETF outflows persist in the coming days, potentially signalling structural changes.

- Whether SOL’s inflows are sustainable and broaden to other altcoins or token-based ETFs.

- How the price action of each underlying asset responds to the ETF flow differential: will BTC/ETH suffer from sustained redemptions, and will SOL benefit from the inflows?

- The influence of macro-economic variables (interest rates, regulatory developments, liquidity conditions) on ETF flows and crypto investor behaviour.

Bottom Line:

On November 18, 2025, spot crypto ETF flows illustrated a notable shift: substantial outflows from Bitcoin and Ethereum funds accompanied by modest but meaningful inflows into Solana. For market watchers, this points to an evolving allocation landscape where altcoin-based ETF products are becoming more relevant — potentially marking the early stages of a broader diversification of institutional crypto exposure.

Also Check: Malaysia Reports Over US$1.1 Billion Loss at TNB Due to Illegal Crypto Mining Power Theft

CUF7YUJW