Summary:

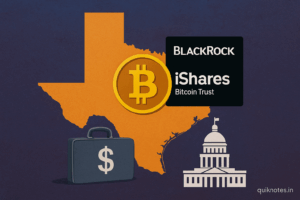

The state of Texas has made history by becoming the first U.S. state to invest public funds in Bitcoin. On November 20, it purchased US$5 million worth of shares in iShares Bitcoin Trust (IBIT), managed by BlackRock — marking the first official state-level exposure to BTC via its newly created digital-asset reserve program.

What Happened

- Under the recent law passed in 2025 creating the Texas Strategic Bitcoin Reserve, Texas allocated funds to begin building a stash of Bitcoin for its state treasury.

- The first tranche — US$5 million — was used to purchase shares of IBIT on November 20. The acquisition was disclosed by Texas Blockchain Council via social media.

- Texas officials say this initial move is part of a broader $10 million allocation approved under the reserve legislation — with future buys possibly including self-custodied Bitcoin after a secure custody framework is established.

Why It Matters

State-Level Endorsement of Crypto as a Strategic Asset:

This marks the first time a U.S. state has publicly deployed taxpayer-backed funds for Bitcoin — a major shift in how governments view digital assets. It elevates Bitcoin from a niche, retail-focused asset to part of public finance strategy.

Legitimizing Crypto in Public Finance:

Using a regulated ETF (IBIT) allows the state to gain exposure without direct custody risk, while it sets up long-term custody infrastructure. This could serve as a model for other states — or even countries — considering diversification beyond traditional assets.

Potential Impact on Bitcoin Demand & Market Dynamics:

Though $5 million is modest relative to overall state budgets, symbolic moves like this — publicly disclosed, state-backed — may spur institutional momentum. Additional planned purchases and self-custody moves could add more structural demand.

Broader Trend: Institutional + Government Adoption:

The move aligns with ongoing efforts by universities, institutions, and private firms to hold Bitcoin. The state’s entry may accelerate adoption across public-sector entities and influence how digital assets feature in long-term reserves and balance sheets.

What to Watch Next

- Further Allocations & Custody Plans: Whether Texas will deploy the remaining $5 million, and how it will manage custody once its infrastructure is ready.

- Other States’ Reactions: Whether other U.S. states will follow by enacting similar reserve laws or purchasing BTC via ETFs or self-custody.

- Regulatory Environment: Whether federal or state-level regulators provide clarity on accounting, custody, and reporting standards for government-held crypto.

- Bitcoin Price & Volatility: How price swings post-purchase affect public perception and the political calculus for holding volatile assets in government portfolios.

- Transparency & Public Scrutiny: As state funds are involved, expect scrutiny over disclosure, reserve accounting, risk management, and long-term fiscal impact.

Bottom Line

By purchasing $5 million in BlackRock’s IBIT ETF, Texas has broken new ground — becoming the first U.S. state to allocate taxpayer funds into Bitcoin. While modest in size, the symbolic and financial implications are significant: the move signals growing acceptance of crypto-assets in public finance, the possibility of state-level digital-asset reserves, and could pave the path for broader institutional and governmental adoption of blockchain-native monetary instruments.

4PL6YLOQ