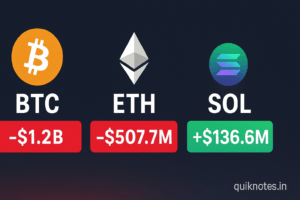

Spot exchange-traded funds (ETFs) tied to Bitcoin (BTC) and Ethereum (ETH) experienced a sharp divergence in fund flows this week, with roughly US $1.2 billion in net outflows from BTC-based ETFs and approximately US $507.7 million outflow from ETH-based ETFs. In contrast, ETFs linked to Solana (SOL) recorded an estimated US $136.6 million in net inflows, making it the only major crypto asset to attract fresh capital this week.

Key facts

- Bitcoin spot ETFs saw outflows near $1.2 billion this week, reflecting investor withdrawals or repositioning.

- Ethereum spot ETFs recorded about $507.7 million in net outflows over the same period.

- SOL-linked ETFs bucked the trend, with roughly $136.6 million in net inflows, indicating some rotation into Solana-related exposure.

- The divergence in flows signals shifting investor sentiment: from the two largest tokens toward potentially higher-risk/reward alternatives like Solana.

- While exact fund names and regional breakdowns were not publicly detailed in full, multiple ETF-flow data providers confirmed the broad figures via weekly tracking.

Why it matters

- Flow dynamics matter for price direction: Spot ETF flows are an important gauge of institutional and retail interest. Outflows in BTC and ETH ETFs may signal profit-taking, risk-reduction or reallocation. Inflows into SOL suggest selective optimism or thematic bets around Solana’s ecosystem momentum.

- Market leadership may be shifting: Bitcoin and Ethereum have long dominated crypto-asset inflows; if funds are now tilting toward alternative tokens like Solana, that may reflect evolving narratives (layer-1 platform activity, ecosystem growth, token-staking yields) and could lead to relative out-/under-performance of the majors.

- Implications for crypto asset allocation: Fund managers and investors tracking ETF flows might adjust allocations—reducing core BTC/ETH exposure and increasing around higher-beta platforms. The relative inflow into Solana may trigger broader interest in its network developments, staking returns or ecosystem announcements.

- Liquidity and market-structure risk: Large outflows from major buckets (BTC/ETH) could influence bid-ask spreads, futures basis, derivative hedging costs and secondary-market price action — especially in times of market stress.

What to watch

- Breakdown by fund provider and region: Identifying which specific ETFs (for example those managed by major issuers) experienced the outflows/inflows will clarify investor type and geography.

- Asset-price response: Watch how BTC, ETH and SOL prices respond to these flows in the coming days: will the outflows correlate with price weakness in BTC/ETH and a rally in SOL?

- Narrative shifts: Solana inflows suggest a thematic pick-up—look for announcements from the Solana ecosystem (new apps, partnerships, staking incentives) that may be driving this.

- Continued flow trends: Is this week an anomaly or the start of a trend? Subsequent weeks will indicate whether funds continue to rotate away from BTC/ETH or revert.

- Macro/regulatory triggers: Broader crypto-market influences (Fed rate decisions, regulation, institutional adoption) may impact flows across all tokens and not just asset-specific stories.

Risks & considerations

- Flow data limitations: ETF-flow figures are often aggregated and may not capture every variant or region; regional restrictions or delayed disclosures may skew numbers.

- Outflow ≠ bearish for asset necessarily: Large withdrawals from ETFs could represent profit-taking or reallocation rather than loss of confidence; asset fundamentals (protocol activity, network growth) still matter.

- Inflow ≠ sustainable rally guarantee: While Solana’s inflows are notable, inflows alone don’t guarantee long-term performance—ecosystem execution, token-economics and macro backdrop matter.

- Short-term volatility: Large shifts in fund flows can coincide with heightened volatility; investors should manage risk exposure accordingly.

Bottom line

The latest weekly flow data show a notable divergence in investor interest: major tokens Bitcoin and Ethereum are seeing outflows, while Solana is capturing net inflows. This may indicate a shift in sentiment and allocation from “core crypto” exposure toward platform-level narratives with higher growth potential. Market participants will be closely monitoring whether this rotation holds or reverses—and what that means for asset-price leadership, liquidity and thematic focus in the crypto ecosystem.

479QQQRE