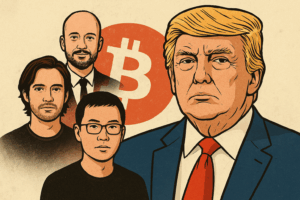

Former U.S. President Donald Trump has granted a series of high-profile pardons in the cryptocurrency industry, including to Changpeng Zhao (“CZ”), founder of Binance; Ross Ulbricht, founder of the darknet marketplace Silk Road; and executives tied to BitMEX. These actions have triggered renewed concerns among ethics experts and watchdogs that the clemency process may be influenced by crypto-industry ties, lobbying and political favour.

What has happened

- On October 23, 2025, Trump issued a full pardon to Binance founder Changpeng Zhao, who pleaded guilty in 2023 to U.S. anti-money-laundering violations and served four months in prison.

- Earlier in 2025, Trump pardoned Ross Ulbricht on January 21 — originally given a double life sentence plus 40 years for operating Silk Road.

- On March 27, 2025, he pardoned the founders and senior employees of BitMEX (Benjamin Delo, Arthur Hayes, Samuel Reed, Gregory Dwyer) who had pleaded guilty to violating the Bank Secrecy Act by failing to maintain an adequate AML/KYC program.

Why this matters

These pardons raise several intertwined issues:

- Regulatory accountability: Binance’s $4.3 billion settlement with the U.S. and Zhao’s prison sentence were viewed as landmark enforcement actions. The pardon may be seen as undermining those outcomes.

- Political-industry ties: Reports indicate significant overlaps between the crypto industry, the Trump family’s crypto ventures (e.g., World Liberty Financial) and lobbying by crypto firms seeking clemency.

- Ethics and fairness in clemency: Compared with most previous pardons which focused on lower-level offenders or non-financial crimes, these are high-profile, heavily regulated crypto individuals. Experts warn this could create perceptions of pay-to-play or undue influence.

- Industry implications: The crypto industry is watching closely. These pardons may embolden firms that faced enforcement, but also raise investor/regulatory concerns about future oversight.

Voices and concerns

Critics have been vocal:

- Elizabeth Warren, U.S. Senator (D-MA), called the pardon of CZ “a payoff and a blatant example of the kind of pay-to-play corruption that Trump and his Administration continue to engage in.”

- Legal ethics expert Richard Painter (former White House ethics lawyer) said: “This is the first time one has involved the President’s personal businesses and personal money.”

- From the industry side, some see the pardons as a welcome reset, especially given regulatory pressure under the previous administration. However, others worry about the message this sends to those who were held accountable.

Broader context

- The U.S. crypto-regulation landscape has been in flux: from aggressive enforcement under the Janet Yellen / U.S. Department of Justice era to a more pro-crypto stance under Trump’s second tenure.

- Pardons for crypto figures follow a trend of Trump-era clemency increasingly involving white-collar, financial-market offences rather than traditional low-level criminal cases. The crypto dimension adds layers of regulatory, political and technological complexity.

What to watch

- Congressional oversight: Will there be hearings or investigations into whether the crypto industry unduly influenced the clemency process?

- Regulatory reaction: How will regulators (DOJ, SEC, CFTC) respond to a pardon-era that appears to reverse high-profile enforcement?

- Industry behaviour: Will crypto firms see this as a signal to ramp up lobbying, or will the reputational risk deter such efforts?

- Legal precedent: Will future enforcement expectations shift if high-level offenders receive pardons?

- Investor implications: Does the perception of politicised pardons affect institutional trust, compliance cost and capital flows in crypto?

Bottom line

The wave of crypto-industry pardons issued by Donald Trump — targeting figures such as Changpeng Zhao, Ross Ulbricht and senior BitMEX executives — has triggered intense scrutiny over ethics, politics and regulatory accountability. While supporters argue these moves reflect a pro-innovation, pro-crypto agenda, critics say they expose risks of preferential treatment, conflicts of interest and weakened enforcement. The coming months will test whether the regulatory and political systems can maintain trust in the oversight of novel-asset markets.

Also Check: Citigroup and Coinbase Global Team Up to Trial Stablecoin Payments for Corporate Clients

ZIEC6TE4