Key Takeaways

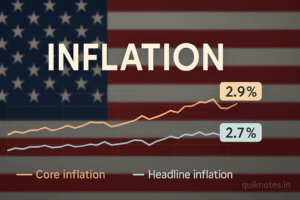

- The U.S. Commerce Department reported that Core PCE (Personal Consumption Expenditures price index, excluding food and energy) rose 2.9% year over year in August, matching market expectations.

- The overall PCE price index increased 2.7% year over year and 0.3% month over month.

- These readings show inflation remains above the Federal Reserve’s 2% target, presenting a challenging backdrop for monetary policy.

What the Numbers Say

Core PCE Keeps Steady

Core PCE, a key inflation gauge that excludes volatile food and energy prices, held at 2.9% year over year, the same as in July. On a monthly basis, core PCE is reported to have risen by 0.2% in August.

Economists often view core PCE as more reliable for guiding monetary policy because it filters out the more erratic components of inflation. Its stability suggests that underlying price pressures remain persistent.

Headline PCE Also Tick Up

The broader PCE measure, which includes all consumer goods and services, rose 0.3% on a month-to-month basis in August. Over the year, headline PCE rose 2.7%, up from 2.6% in July.

This suggests that inflation is gradually creeping upward across the economy—not just in the “core” components but more broadly.

Why It Matters for the Fed and Markets

- Monetary policy implications: The Fed closely monitors core PCE as its preferred inflation measure. At 2.9%, it’s above the 2% target, which may complicate calls for aggressive rate cuts.

- Tightrope for rate cuts: With inflation still elevated, the Fed has to balance the desire to support growth and employment with the risk of allowing inflation to spiral.

- Market expectations: Participants will scrutinize future inflation reports and Fed communications closely to gauge when rate cuts might resume—or whether they’ll be delayed.

- Anchor for inflation expectations: Persistent core inflation may influence long-term expectations (e.g., wage demands, contracts, financial forecasting) if it remains sticky.

Context & Commentary

- The Dallas Fed has noted that core PCE has held above 2.5% since mid-2024, citing sustained inflationary pressures especially from non-housing core services and housing costs.

- Analysts had anticipated core PCE to remain at 2.9% for August, with overall PCE rising 2.7%.

- The moderate 0.3% monthly rise in headline inflation aligns with expectations and shows that although inflation is rising, it is doing so at a controlled pace.

What to Watch Next

- Upcoming Fed meeting minutes / statements will be critical to see how inflation weighs on policy guidance

- Data on wages, employment, producer prices, and consumer sentiment will help judge whether inflation will accelerate further

- Future PCE and CPI prints will be closely watched to see if this pattern of inflation persistence continues or weakens

Bottom Line

August’s inflation report showed Core PCE steady at 2.9%, while headline PCE rose 2.7% annual and 0.3% monthly—figures broadly in line with expectations. Inflation remains above the Fed’s 2% goal, which could make the central bank cautious about aggressive rate cuts. As policymakers and markets digest the implications, upcoming economic data and Fed communications will be key to interpreting direction.

Also Check: Perp DEX Trading on BNB Chain Surges Past $67B on Sept. 24; Volume Spikes Raise Wash-Trading Concerns

2WFR0XLG